In the face of global challenges, including wars and global emergencies impacting market dynamics, the pharmaceutical industry continues to be the foremost example of a sector that operates around the clock. In 2023, the pharmaceutical market worldwide remained at the center of public and medical focus, driven by both the aftermath of the COVID-19 pandemic and the emergence of new health challenges. The pandemic underscored the medical sector's vital role in global health and accelerated trends such as drug development, enhanced R&D, digital transformation, and personalized medicine. Leading pharmaceutical companies like Johnson & Johnson, merck, and Roche were highlighted for their ongoing advancements in drugs and treatments, demonstrating the industry's capacity for rapid innovation and resource mobilization in times of urgent need.

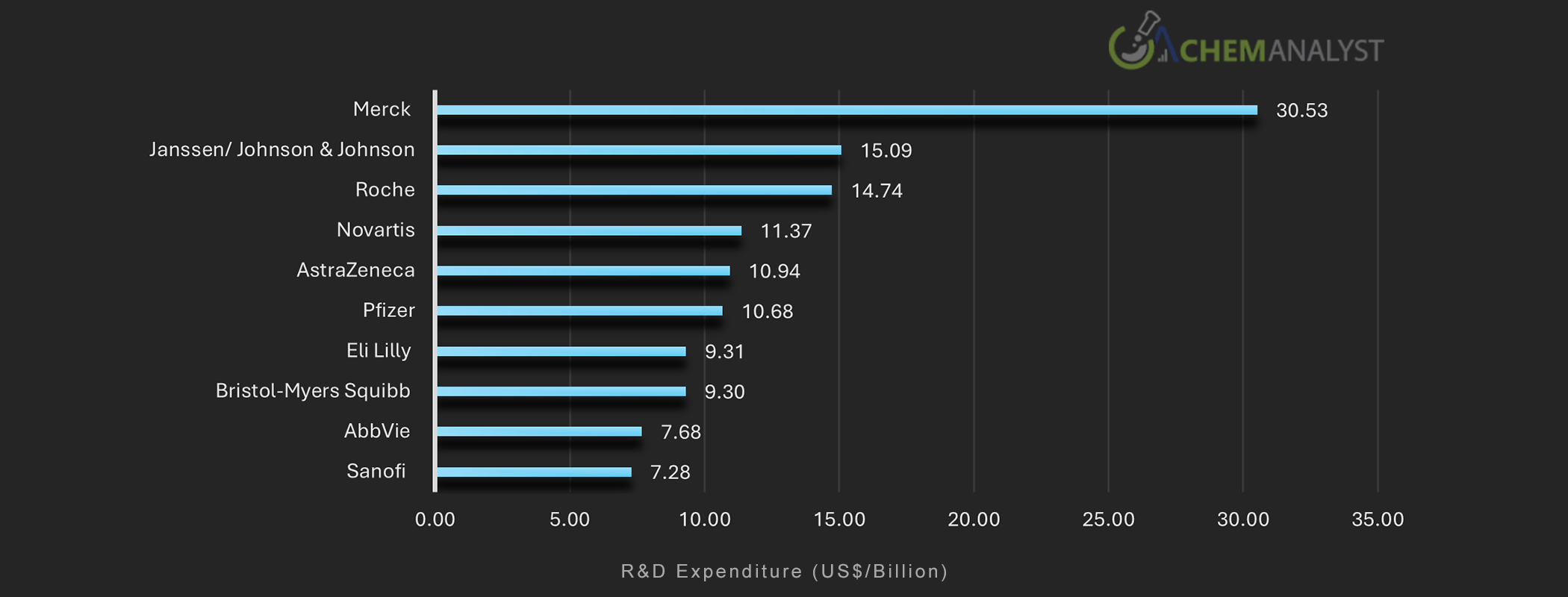

In 2023, the industry also made significant strides in other therapeutic areas, with substantial investments in R&D for oncology, immunology, and cardiovascular diseases. Emerging markets, including China and India, continued to grow in importance as significant manufacturing hubs and expanding markets for pharmaceutical products. These nations have been heavily investing in biotechnology and pharmaceutical R&D, despite facing challenges related to intellectual property rights and regulatory compliance.

Digitization remained a key trend shaping the industry. Pharmaceutical companies increasingly leveraged data analytics and artificial intelligence for drug discovery, clinical trials, and market research, helping to shorten the drug development cycle and reduce costs. However, the industry faced its fair share of challenges. Regulatory scrutiny of drug safety and effectiveness grew globally. The impending "patent cliff," where many popular drugs will lose patent protection, posed a serious threat to revenue streams. Additionally, governments and advocacy organizations increased pressure for more transparent pricing structures and easier access to essential medications.

In conclusion, the pharmaceutical sector in 2023 was characterized by rapid advancements and significant challenges, reflecting its resilience, innovation, and crucial role in addressing global health issues.

Therefore, by comparing the financial performance of the global pharmaceutical market in 2023 to 2022, ChemAnalyst aims to highlight the impact of market uncertainties and challenges on this industry through this study.