Welcome To ChemAnalyst

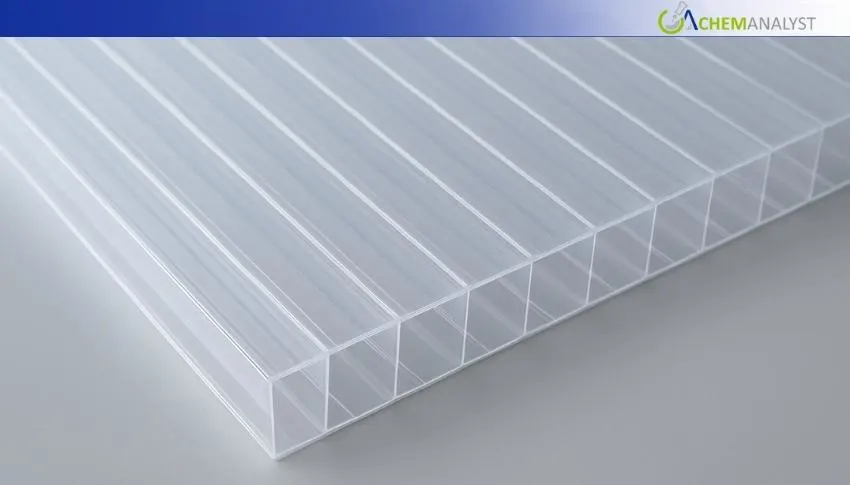

Asian polycarbonate (PC) prices declined in late August due to oversupply, weak demand, and limited cost support from raw materials. Despite stable production and high inventory, downstream activity remained sluggish. Traders faced financial pressure, leading to discounts and slow circulation. Market sentiment stayed cautious, with no signs of short-term recovery.

Key Highlights

The Asian PC market also remained under pressure during the last week of August, with prices further declining owing to continued oversupply and weak demand. Market players indicate that even as production levels have remained stable, the market is still dull, with no indications of recovery in the near future.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.