Welcome To ChemAnalyst

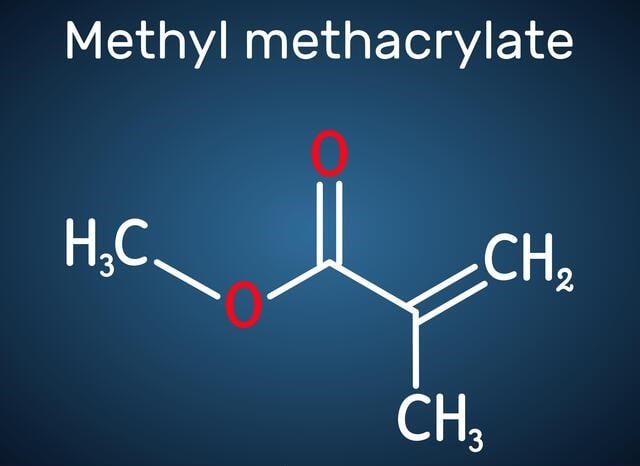

In this month, the price of Methyl Methacrylate in Asia remained weak where the contract prices were hovering around $1750/ton-$1830/ton and spot prices were observed to be $1900/ton-$2000/ton. The general purpose (GP) PMMA price is in the range of $2,000-2,250/MT CFR Southeast Asia. China PMMA prices continued to be under downward pressure. PMMA price is in the range of $2207/ton-$2365/ton pmt DEL, depending on the origin and end-use.

The feeble market of Methyl Methacrylate was driven by the downward pressure of numerous downstream customers closing down from middle January for the Lunar New Year occasion, and the sceptical economy viewpoint because of the Covid-19 new variation -Omicron pandemic crisis. On the supply side, recently several Methyl Methacrylate plants in China either reduced creation rate or scale back the production as arranged due to transportation limitation as a component of the preparation for the Beijing Winter Olympics in February. Subsequently it's heard the Methyl Methacrylate plants normal working rate was around 60-70%. Naphtha prices were increased by $50-$100/MT to $730-$780/MT, and methanol prices were slightly rebounding to$410-$430/MT. In North Asia, the downstream interest of General purpose (GP) polymethyl methacrylate (PMMA) stays feeble and a few suppliers might have selling pressure. In Southeast Asia also the market was weak with sufficient supply and deteriorating demand. Most cast sheet producers hesitated to build up their MMA inventory. In Indonesia, domestic market seems steady. Vietnamese domestic market demand seems solid. In Thailand and Malaysia, homegrown market appears to be negative and in India the market was seen to be drowsy.

According to ChemAnlayst, it is estimated that the Methyl Methacrylate supply in Asia will be balance to tight in February and March, therefore hesitate to reduce the prices across the board. The downstream enterprises are expected to operate their plant cautiously according to the consumer’s demand. Higher freight cost and lower purchasing activities can be seen in this month. However, logistics constraints and higher freight cost can hamper the prices of Methyl Methacrylate in Asian region.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.