Welcome To ChemAnalyst

In March 2022, the global commodity cycles showcased mixed sentiments throughout the month amidst the persistent gyration in the international crude oil market. This swing in the Crude Oil market was induced due to the conflict in the eastern European region when Russia started its special military operations on Ukraine. Such a trend in the market dynamics was majorly supported by the strengthened will to the dismemberment of the Russian Crude and to divert attention toward the Middle eastern supplies.

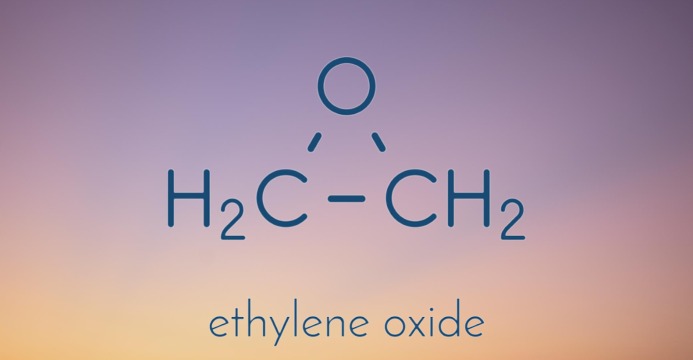

The largely impacted market in Northeast Asia is Japan, as several major players were more dependent on Russian Crude Oil. Due to the sanctions imposed on Russia, several Japanese refiners announced to source their Crude oil from other suppliers to safeguard their interests. This came as a setback to the Japanese market as the CFR Japan Naphtha crossed the USD 1000 per tonne mark during mid-March. Unfortunately, it levied its impact on the downstream petrochemical market besides strengthening the will of Ethylene Oxide producers to raise the offered quotations. After analyzing the pricing trend of Ethylene Oxide, it is concluded to be one of the most price-sensitive commodities in March, and bullish sentiments are persistently prevailing in the Japanese domestic market.

The sentiments in the Chinese market acted opposite to the trend in the Japanese market. After the Beijing Winter Olympics 2022 ended, the Ethylene Oxide market took a standstill stance. Before that, the quotations maintained a persistent bullish sentiment with the support of several market factors, such as pressurized supplies and lavish demand from the domestic downstream market. Even though the global gyrations in the international crude oil market have a little to negligible impact on the prices of Ethylene Oxide in China, since then, the quotations have fluctuated within a rangebound. The market dynamics were much more complicated in the Chinese spot market. According to the market sources, the feedstock Ethylene was consistently gaining value, despite that the quotations change negligibly. Several market participants believe that such a trend was majorly supported by the inadequate demand in the domestic market. Although, the resurgence of COVID has diminished the profit margin as the spread between Ethylene-Ethylene Oxide constantly narrowed and the producers have reduced their operating rates to safeguard their interests.

As per ChemAnalyst, the Japanese market is likely to stagger proportionally with the Crude Oil value. Whereas the market factors for the Ethylene Oxide market in China are forming a bubble amidst diminishing margin leading to curtailed production against the belief of market participants about the rebound in demand from the building and construction sector.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.