Welcome To ChemAnalyst

The impact of the ongoing conflict in the eastern European region has prevailed in second quarter and the presence of the gyration in the energy commodities consistently worried the market players across the globe. The results of the sanctions on Russia made several major refiners reluctant to procure the Russian cargoes of energy supplies, whereas in Northeast Asia several players decided to restrategize the operations on a complete value chain after the persistent pressure applied by the western authorities. Such developments clouded the recovery of growth rate after the losses occurred during the pandemic. The cost support from the upstream Naphtha in the northeast Asian region witnessed a consistent staggering trend amidst the uncertainties in the spot market. The spreads of Naphtha in comparison with several downstream commodities witnessed persistent changes identical to the price fluctuation.

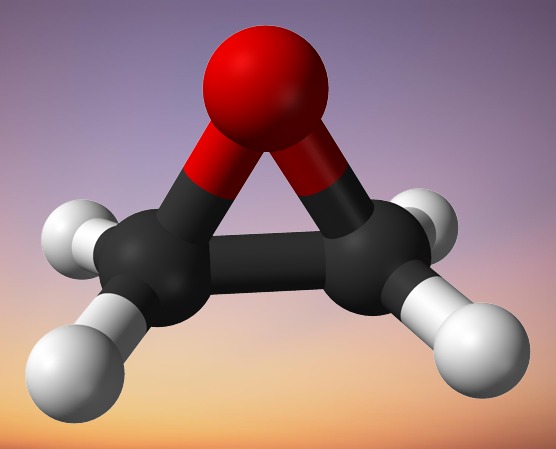

Although in last week, the benchmark for the feedstock Ethylene offers in the Northeast Asian region plunged marginally despite the firmer upstream energy values. There were several speculations in discussions about the uncertain behavior of the price movement but the majority were in favor of the maintenance shutdowns in several terephthalic acid facilities across the Asia Pacific that depressed the market sentiments and caused numerous fluctuations in the Naphtha prices. In addition, a major Ethylene facility with a production capacity of 527,000 tonnes per year was on a maintenance turnaround for over a month in Japan and is likely to restart the production in the current week which strengthened the supply outlook. Whereas, the COVID-related uncertainties in China presents several challenges for the Ethylene Oxide producers as the production margins were consistently narrowed and the operational rates were dropped to maintain a better netback.

As per ChemAnalayst, the current market movement is quite unpredictable as the war-related inflation is likely to create hindrance in the market sentiments. Whereas several market players were closely monitoring the peace talks between Russia and Ukraine in anticipation that it’ll relieve the pressure from the supply chain that strengthened the wait-and-see sentiments in several markets. Also, numerous market players were reluctant toward the Russian supplies as the players were angst about the upcoming developments.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.