Welcome To ChemAnalyst

In September of 2025, the US market witnessed a consistent rise in Potassium Sorbate import prices. The prices went up consistently at a level of 0.8 percent throughout the month, indicating consistent demand and possibly low levels of supply. This is indicative of the increasing importance of Potassium Sorbate in applications such as food preservation and medicine. Market analysts are looking for the trend to persist in the immediate term owing to strong demand and possible global supply chain hurdles. Investors are advised to watch market trends intently since price action would have implications for procurement policy and cost of production. The ongoing increase in prices highlights the necessity for planning strategically to counter threats from possible future increases in import prices.

Key Point Indicators

The US market witnessed a slight increase in the September 2025 import price of potassium sorbate, with prices increasing steadily by 0.8 percent. This is a testament to increasing demand and market forces that continue to drive the pricing of this ubiquitous food additive. Market analysts forecast the trend to persist in the short term, with market indicators indicating further growth.

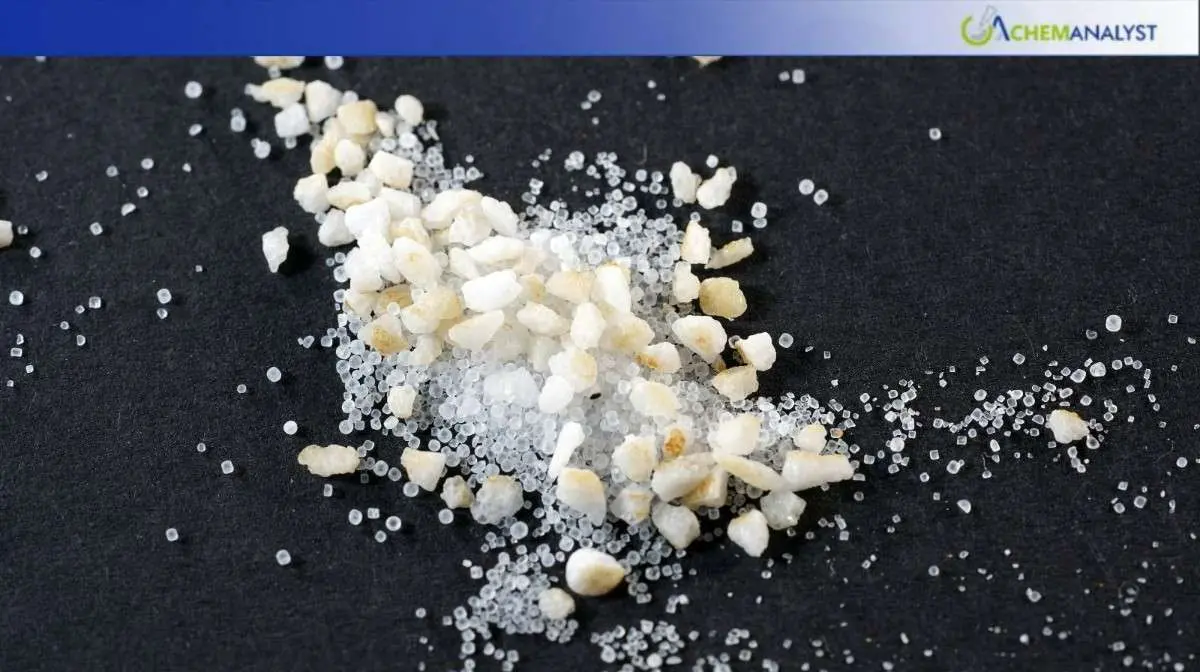

Among the most popular food and beverage ingredients, potassium sorbate finds extensive application as a mold, yeast, and microbial inhibitor in baked foods, dairy products, and beverages. Regardless of whether or not the drug is effective, added to its added effectiveness has made it a needed ingredient among numerous producers who desire to prolong shelf life of potassium sorbate alongside product quality. Thus, its cost has been kept constant in terms of demand, and hence the resultant consistent upward movement in the prices of imports. September's 0.8 percent is an extension of the consistent trend seen in recent months. Industry analysts link a combination of factors to the trend such as supply chain issues, the vagaries of raw material prices, and changing consumer tastes for packaged and processed foods. These factors have combined to bear down on the supply chain, and this has resulted in incremental pricing movements for potassium sorbate.

Among the most powerful forces pushing prices up is the recovery of the global supply chain from the closure of a year ago. While great progress has been made in restoring supply lines, hitches such as transport costs and bottlenecks at logistics points are still rife. These impose additional costs on importers that are then charged through into potassium sorbate prices. Besides, the increasing cost of input material during potassium sorbate production has gone a long way in shaping the market's cost conditions. Main inputs like sorbic acid and potassium hydroxide have seen cost activity in tandem with geopolitical tensions, energy prices, and environmental protocols attached to production processes. All these went on to push import cost pressure higher.

Consumer demand has also fueled potassium sorbate demand. Due to constant demand for convenience foods and ready-to-eat foods, producers have increased production levels to match the increasing demand. The subsequent rise in demand subsequently had a knock-on effect throughout the supply chain, causing greater buying of potassium sorbate and by higher subsequent prices. The consistent pattern in the price of potassium sorbate affects many players in the market. The higher cost of manufacturing may affect the pricing policy and margins of the manufacturers. Suppliers and importers, though, may see their earnings increase through the sustained demand.

In the next few years, the company is expected to keep growing. Potassium sorbate cost is also likely to continue increasing at a steady but incremental rate based on a mix of supply chain conditions, raw materials, and customer demand. The growth of 0.8 percent in September reflects stability in the trend, and also reflects that there would be more price fluctuation for potassium sorbate in the future. Applications of the compound in various industries such as food and beverages, cosmetics, and pharma are also likely to persist and fuel the demand for potassium sorbate. Moreover, increasing requests for food safety and preservation will also continue to propel its application in manufacturers. In attempts to better respond to this shifting situation, leaders of the industry are emphasizing improving manufacturing processes and supply chain efficiency. Innovation and technologies are being invested in as a way to reduce cost pressures and offer a safe availability of potassium sorbate. Furthermore, inter-stakeholder collaboration in the value chain is being prioritized to overcome challenges and take advantage of potential future opportunities.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.