[Online Quarterly Update] Indian 4- Octylphenol market has shown significant growth by achieving 28 thousand tonnes in FY2020 and is projected to grow at an impressive CAGR of 6.25% during the forecast period until FY2030. 4-Octylphenol (C14H22O) also known as p-tert-Octylphenol comes under a type of high purity Alkylphenols, which is substituted at the para- position by an Octyl group. It is manufactured from diisobutylene and phenol using DIC's proprietary techniques. 4- Octylphenols play a huge role as a xenoestrogen, a surfactant, and a metabolite. They are extensively used for numerous commercial applications such as raw materials for synthetic chemicals, chemical intermediate to UV stabilizers, products for children (e.g., Toys, children's cosmetics), food packaging, paper plates, cutlery, oil phenolic resins, surfactants, pesticides, and many others. 4-Octylphenol also finds its applications in the manufacturing of dispersants, detergents, emulsifiers, wetting agents, foaming agents, cleaning agents, etc. Many industries use 4-Octylphenols as additives in the production of rubbers, lubricating oils, films, or molding materials in order to improve the stability and shelf life.

The surging demand for Phenolic resins by the electrical and domestic appliances market in India owing to the emerging economy and rapid urbanization is likely to propel the demand of 4- Octylphenol, which will further accelerate the Indian 4-Octylphenol market in upcoming years. India’s industry revenue for the manufacturing of electrical equipment using Phenolic resins was around USD 4.18 billion in FY2016 and is projected to grow USD 4.92 until FY2030. The demand for 4- Octylphenols as additives and adhesives by the building and construction end-user industry will boost the Indian 4-Octylphenol market in the forecast period due to increasing construction and infrastructure activities.

In 2020, due to the onset of COVID-19, coronavirus had a far-reaching impact on the Indian 4- Octylphenol market. There was a decline in the demand for 4- Octylphenol by the rubber industry as it witnessed a huge economic downturn. Major drivers of the domestic rubber industry were highly affected including automotive, medical, aerospace, agriculture, and electrical appliances due to disruptions in the supply of raw materials. However, the surfactants industry was positively affected during the covid times as surfactants are consumed for a variety of applications. During the first half of 2020, demand for hard-surface cleaners and disinfectants surged significantly due to extreme sanitization and increased willingness of global consumers to keep their household clean, to lower the risk of infection, which further boosted the Indian market of 4-Octylphenol amid the pandemic.

The supply of 4- Octylphenol in the Indian market is significantly dependent upon the production and availability of phenol and diisobutylene. In India, consumption of 4- Octylphenol is perceived to vary with regions too. North and South regions in India account for major consumption of 4- Octylphenols due to the presence of a large number of end-user industries and vivid distribution channels.

Major players for Indian 4- Octylphenol Market include Chem Connection India, Rimpro India, Shubhra Industries, Unitop Chemicals Pvt., Ltd., AB enterprises, Noble Industries, Dyna Glycols Pvt., Ltd., Matangi Industries, India Glycols, Gujarat Chemicals, Otto Chemie Pvt. Ltd, and others.

Years considered for this report:

Historical Period: FY2015-FY2019

Base Year: FY2020

Estimated Year: FY2021

Forecast Period: FY2022–FY2030

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

Objective of the Study:

• To assess the demand-supply scenario of 4- Octylphenol which covers production, demand and supply of 4- Octylphenol market in India.

• To analyse and forecast the market size of 4- Octylphenol.

• To classify and forecast Indian 4- Octylphenol market based on application, end-use and regional distribution.

• To identify drivers and challenges for Indian 4- Octylphenol market.

• To examine competitive developments such as expansions, new product launches, mergers & acquisitions, etc., of 4- Octylphenol market in India.

• To identify and analyse the profile of leading players involved in the manufacturing of 4- Octylphenol.

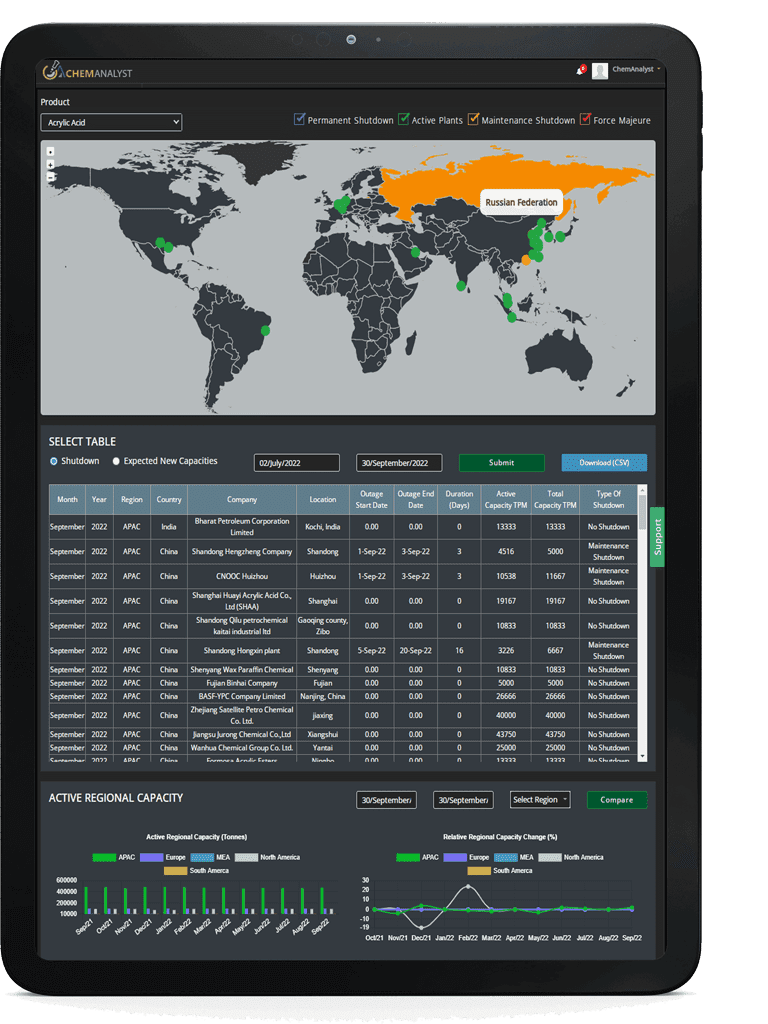

To extract data for India 4- Octylphenol market, primary research surveys were conducted with 4- Octylphenol manufacturers, suppliers, distributors, wholesalers and Typers. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various Typer segments and projected a positive outlook for Indian 4- Octylphenol market over the coming years.

ChemAnalyst calculated 4- Octylphenol demand in India by analyzing the historical data and demand forecast which was carried out considering imported, raw materials used for production of 4- Octylphenol. ChemAnalyst sourced these values from industry experts and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• 4- Octylphenol manufacturers and other stakeholders

• Organizations, forums and alliances related to 4- Octylphenol distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as 4- Octylphenol manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years (next two to five years), thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, India 4- Octylphenol market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size volume in FY2020

|

28 thousand tons

|

|

Growth Rate

|

CAGR of 6.25% from FY2021 to FY2030

|

|

Base year for estimation

|

FY2020

|

|

Historic Data

|

FY2015 – FY2019

|

|

Forecast period

|

FY2022 – FY2030

|

|

Quantitative units

|

Demand in tons and CAGR from FY2021 to FY2030

|

|

Report coverage

|

Revenue forecast, demand & supply, competitive analysis, competitive landscape, growth factors, and trends

|

|

Segments covered

|

1. By Type: (99% Purity and 99.5% Purity)

2. By Application: (Resins, Surfactants, Chemical Intermediates, Pesticides, and others)

3. By Sales Channel: (Direct Company Sale, Direct Import, Distributors & Traders, Retailers)

|

|

Regional scope

|

North India, South India, East India, West India

|

|

Key companies profiled

|

Chem Connection India, Rimpro India, Shubhra Industries, Unitop Chemicals Pvt., Ltd., AB enterprises, Noble Industries, Dyna Glycols Pvt., Ltd., Matangi Industries, India Glycols, Gujarat Chemicals, Otto Chemie Pvt. Ltd, and others.

|

|

Customization scope

|

Free report customization with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com