H1 2023: During the first three months of 2023, prices for isobutylene experienced an increase in the Chinese market. The surge in procurement from downstream polyisobutylene industries exerted an impact on the price value chain of isobutylene. Consequently, manufacturers found it necessary to adjust their offers to secure profit margins due to strong downstream demand. Additionally, the sufficient cost support from feedstock TBA (Tertiary Butyl Alcohol) led to an upward shift in the price realizations of isobutylene in the domestic market. Concurrently, manufacturing activity witnessed a slower expansion in March, attributed to the slower-than-expected economic recovery of China. Moving into the second quarter, the price trend for isobutylene in Asia fluctuated. Initially, prices were firm and rose due to increased production costs stemming from elevated feedstock TBA prices. Mid-quarter, prices exhibited mixed sentiments, with decreases in North Asia and rises in India driven by high demand for downstream MBTE in the automotive sector. Towards the quarter's end, prices declined due to reduced offtakes from downstream MBTE producer Wanhua Chemical in China, leading to elevated domestic inventory levels amid decreased demand from polyisobutylene manufacturers. Simultaneously, a decrease in feedstock prices and softened offtakes from end-users reduced the upstream cost support on production costs in the Chinese market.

The global Isobutylene market has reached around 1780 thousand tonnes in 2022 and is expected to grow at a CAGR of around 4.2% during the forecast period until 2032.

Isobutylene, also known as 2-methylpropene, is a highly flammable, colorless gas with a distinctive odor. Its versatile applications include being alkylated with butane to produce isooctane or dimerized to diisobutylene (DIB), which is then hydrogenated to create isooctane, a fuel additive. The polymerization of isobutylene results in the production of butyl rubber (polyisobutylene or PIB). Isobutylene is also instrumental in the synthesis of antioxidants like butylated hydroxytoluene (BHT) and butylated hydroxyanisole (BHA) through Friedel-Crafts alkylation of phenols. Moreover, it plays a role in the production of methacrolein, MTBE, and ETBE.

The increasing demand for isobutylene in the production of downstream chemicals like MTBE is the major usage of isobutylene. The market for isobutylene is experiencing growth due to its pivotal role as a monomer in polymer production, notably in butyl rubber, polybutene, and polyisobutylene. This expansion is driven by diverse applications such as tire manufacturing, lubricants, adhesives, sealants, and coatings. Additionally, the demand is boosted by isobutylene's key role in producing gasoline blending components like methyl-tert-butyl ether (MTBE) and ethyl-tert-butyl ether (ETBE) for cleaner fuels. Further contributing to market growth are its uses in the production of anti-oxidants, fragrances, and gas odorization products. The market for Isobutylene is poised for growth notably in the production of high-octane aviation gasoline (isooctane) which is used in Aerospace industry. Additionally, it serves as a crucial element in synthesizing butyl rubber, trimers, and various polymers, contributing to its expanding demand. Moreover, Isobutylene plays a key role in the production of antioxidants like butylated hydroxytoluene (BHT) and 4-methoxyphenol, making it valuable in the realms of foods, supplements, packaging, and plastics, further fuelling market growth. Due to these reasons, the global demand of Isobutylene is anticipated to reach around 2750 thousand tonnes by 2032.

Currently, the Asia Pacific region dominates the global Isobutylene market. The Asia Pacific region is poised to maintain its dominance as the largest consumer of isobutylene in the upcoming years, driven by robust economic growth, population expansion, and rapid industrialization. As key economies, including China and India, continue to flourish, there is a heightened demand for isobutylene-derived products across multiple industries, particularly in automotive, construction, and manufacturing. The region's burgeoning chemical industry, coupled with substantial investments in research and development, underscores its pivotal role in the global isobutylene market. Additionally, the ongoing wave of urbanization and infrastructure development further fuels the need for isobutylene in applications ranging from tire manufacturing to fuel additives.

Based on the end-user industry, the Isobutylene market is segmented into sectors like Methyl tert-butyl Ether (MTBE), Butylated Hydroxyanisole (BHA), Butyl Rubber & Polyosobutylene (PIBA), Ethyl Tertiary Butyl Ether (ETBE), Butylated hydroxytoluene (BHT), and Others. However, Methyl tert-butyl Ether (MTBE) is the biggest end-use application of Isobutylene, holding a share of approximately 27% in 2022.

Significant companies in the Global Isobutylene market are BASF SE, Exxon Mobil Corporation, Honeywell International Inc., KANEKA CORPORATION, LyondellBasell Industries Holdings B.V., Nizhnekamskneftekhim, OMV Aktiengesellschaft, Praxair Technology, Inc., Sumitomo Chemical Co., Ltd., TPC Group, Vinati Organics Limited, and Others.

Years considered for this report:\

Historical Period: 2015- 2021

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2032

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

The objective of the Study:

• To assess the demand-supply scenario of Isobutylene, which covers the production, demand, and supply of Isobutylene around the globe.

• To analyze and forecast the market size of Isobutylene.

• To classify and forecast the Global Isobutylene market based on end-use and regional distribution.

• To examine global competitive developments such as new capacity expansions, mergers & acquisitions, etc., of the Isobutylene market.

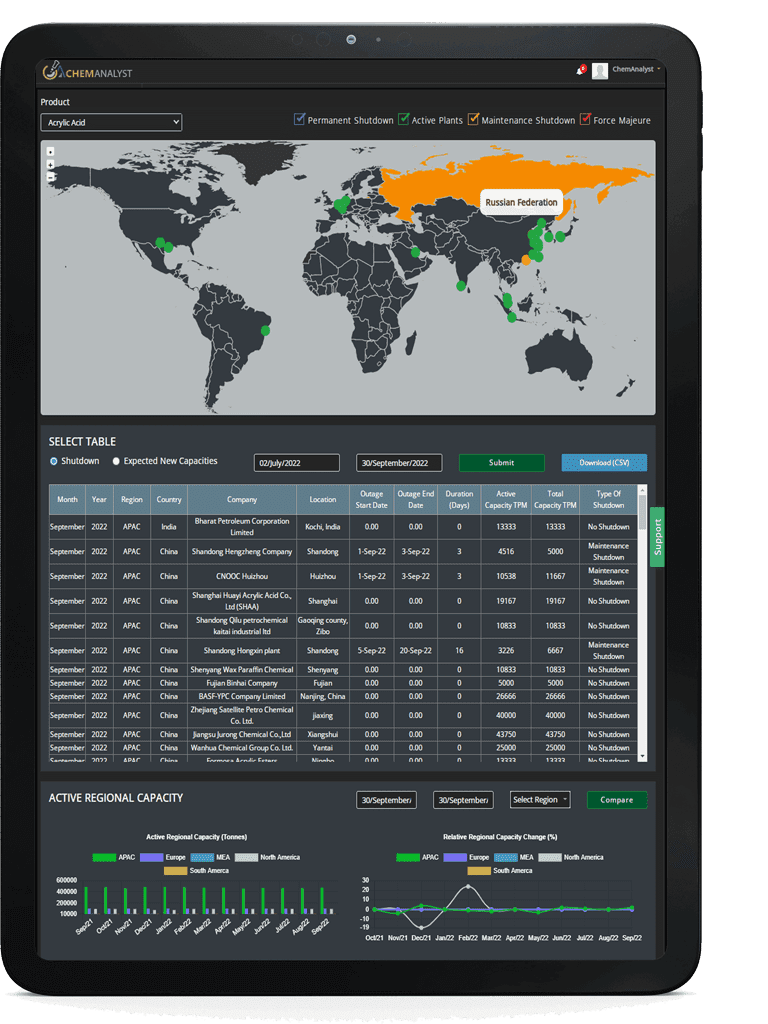

To extract data for the Global Isobutylene market, primary research surveys were conducted with Isobutylene manufacturers, suppliers, distributors, wholesalers, and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for the Global Isobutylene market over the coming years.

ChemAnalyst calculated Isobutylene demand around the globe by analyzing the historical data and demand forecast, which was carried out considering the refining capacity to produce Isobutylene. ChemAnalyst sourced these values from industry experts and company representatives and externally validated them by analyzing the historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources, such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Isobutylene manufacturers and other stakeholders

• Organizations, forums, and alliances related to Isobutylene distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Isobutylene manufacturers, customers, and policy makers. The study would also help them to target the growing segments over the coming years, thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Isobutylene market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

1780 thousand tonnes

|

|

Market size Volume by 2032

|

2750 thousand tonnes

|

|

Growth Rate

|

CAGR of 4.2% from 2023 to 2032

|

|

Base year

|

2022

|

|

Estimated Year

|

2023

|

|

Historic Data

|

2015 – 2021

|

|

Forecast period

|

2024 – 2032

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2032

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Operating Efficiency, Production by Company, Demand by End- Use, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share, Manufacturing Process.

|

|

Segments covered

|

By End-Use: (Methyl tert-butyl Ether (MTBE), Butylated Hydroxyanisole (BHA), Butyl Rubber & Polyosobutylene (PIBA), Ethyl Tertiary Butyl Ether (ETBE), Butylated hydroxytoluene (BHT), and Others.)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.

In case you do not find what, you are looking for, please get in touch with our custom research team at sales@chemanalyst.com.