Welcome To ChemAnalyst

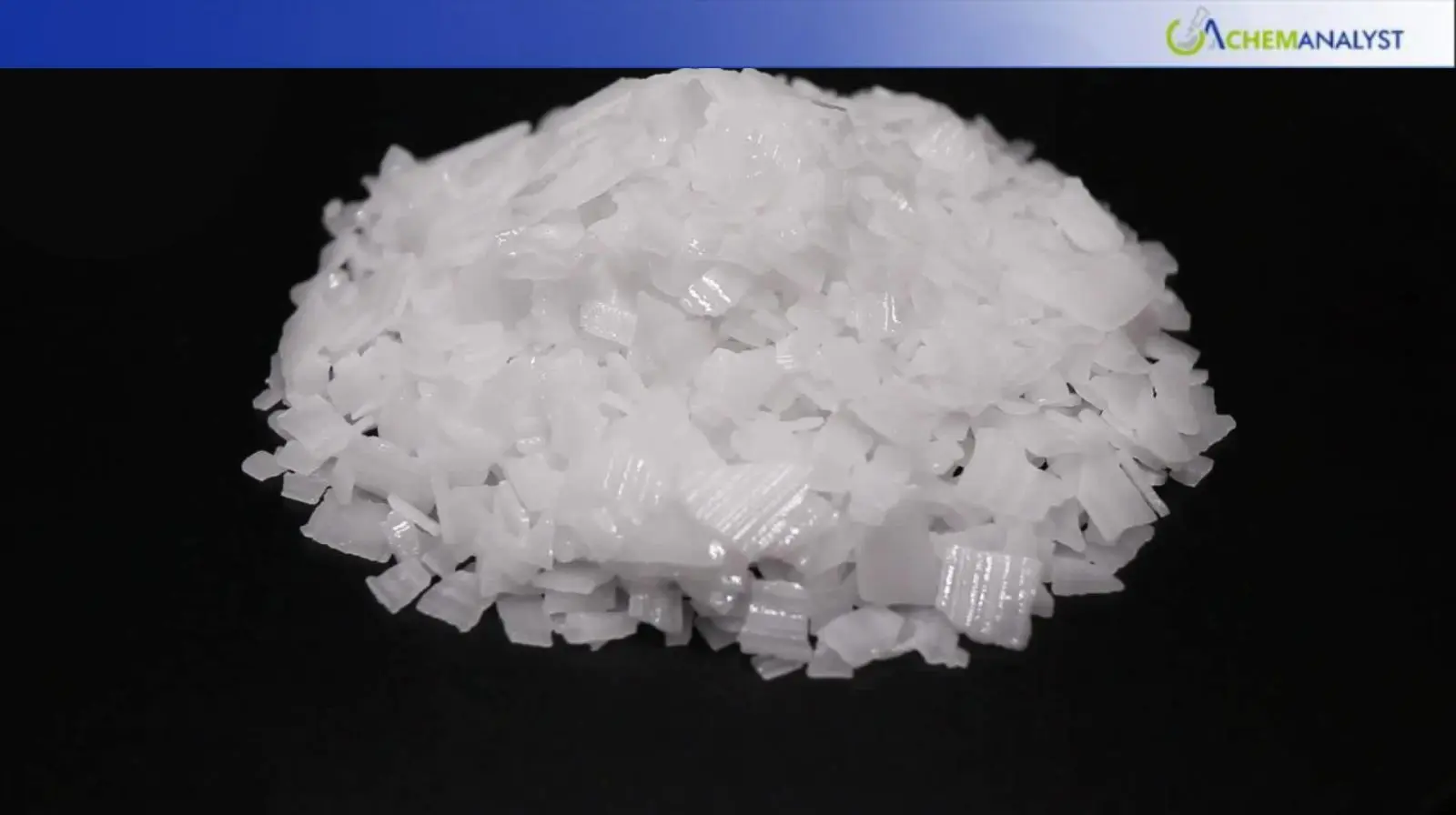

The Asian caustic soda market is firm on guarded buying and weak pressure on stocks, and the U.S. market is weakening as aluminium demand softened during the first half of September 2025.

The global caustic soda market was in conflicting trends this week with the price being generally steady in the main Asian markets but softening in the United States because of weakening aluminium demand.

China's caustic soda market continued to be stable in tone. The market went down for Shandong Province. Though the market declined, domestic manufacturers reported low inventories and no pressure, which reflects a balanced supply-demand situation. Jiangsu Province Caustic Soda prices were unchanged in accordance with continued demand. Inner Mongolia's market continued to consolidate in the process.

The past recent fall in alumina prices, both domestically in China and in the overseas market has squeezed Chinese alumina producers' profit margin. As a result, downstream users, including aluminium and cleaning industry, are purchasing caustic soda spot just in time in recent times. Such conservative purchases have kept the market from overheating, maintaining a healthy price condition for the time being.

Asia's caustic soda market is currently weak but not under severe pressure. With inventory positions under control and demand being met by purchasing on demand, the market is expected to continue consolidating in the near term. Price action going forward will mainly depend on fluctuations in downstream demand, especially from the aluminium sector.

On the other hand, the U.S. caustic soda industry is facing headwinds. Downstream demand for Aluminium in North America fell 4.4% in the first half of 2025, the Aluminium Association reported. The reduction, primarily caused by reduced exports, touched all sectors other than the foil sector. Domestic shipments from domestic producers and Canadian producers fell 4.5% on a year-over-year basis during June, further wiping out caustic soda demand.

Aluminium Association President and CEO Charles Johnson also urged smarter trade policies to the advantage of the industry. "With 98% of American aluminium jobs in the mid- and downstream sectors, we need a more targeted trade approach that keeps America's aluminium industry strong and competitive while guarding against unfair practises," he said.

On the contrary, while aluminium prices have risen sharply over USD 2,700 per tonne on the strength of Federal Reserve rate cuts and tightened global supply, alumina prices continue to trend lower this week. This mismatch is complicating the caustic soda market, especially in regions where aluminium smelting is a major consumer.

The Asian caustic soda market is strong in spite of cautious purchasing and low inventory pressure, while in the United States it is softening in the face of weakening aluminium demand.

Asia's caustic soda market is likely to follow its consolidating trend due to tight inventory levels and judicious downstream purchasing,

As per ChemAnalyst, as alumina prices continue to decline, buying from aluminium producers likely to remain subdued, which would keep caustic soda suppliers under pressure. In the United States, the outlook remains bearish with aluminium demand remaining weak and diminished export volumes.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.