Welcome To ChemAnalyst

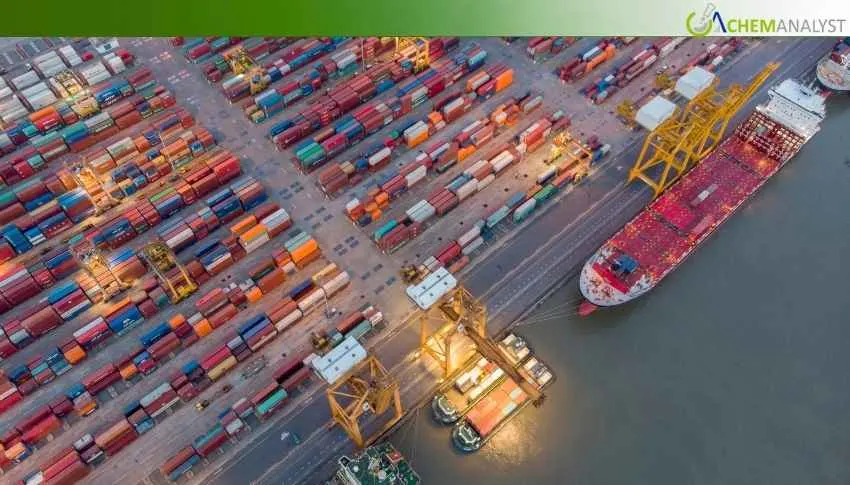

Global ocean freight ended October in a state of managed volatility as carriers leaned on capacity cuts and blank sailings to lift spot rates even as underlying demand softened and geopolitical shocks threatened flows.

Carriers' deliberate capacity management involving mid-month General Rate Increases (GRIs), blank sailings and selective service withdrawals pushed ex-Asia spot rates sharply higher from mid-October lows. Transpacific rates to the US West Coast jumped roughly 18% week-on-week, and Asia–Europe lanes were up by double digits after GRIs took effect.

At the same time, carriers are trading volume for utilization: several smaller lines exited or trimmed Asia–US loops and major alliances tightened offered tonnage, keeping utilization high and spot rates above their recent troughs. Schedule reliability has improved versus 2024 (mid-60% range), but blank sailings continue to create short, painful pockets of capacity tightness.

Geopolitics and tariffs remain the dominant wildcards. Ongoing US–China trade tensions, including a threatened 100% tariff date and new USTR port-call fees, have encouraged both frontloading and re-routing decisions. Operational incidents amplified the uncertainty. Shanghai has levied heavy reciprocal charges on some US-linked vessels. A recent incident went into the spotlight where a US-flagged container ship was charged about $1.7m to dock, and US customs reclassifications have produced unexpectedly large fee bills for some operators (Atlantic Container Line cited a $34m port-fee hit). Such isolated but high-value shocks are forcing carriers to reshuffle sailings and review port rotations.

Other risk factors like Houthi activity in the Red Sea and the ongoing fragile regional environment are keeping some ships off the Suez route and adding voyage time (many still opt to sail around Africa), inflating voyage times costs while straining schedule reliability.

Looking ahead, rate volatility is anticipated to persist into the forthcoming months as carrier balance utilization discipline against political uncertainty. If US–China talks produce a credible de-escalation, pressure on volumes could ease, and spot rates may drift down from their post-GRI bumps. Conversely, renewed tariff action or broader reciprocal measures would likely trigger another round of frontloading, routing changes, and further volume declines at vulnerable US gateways. Importers should watch: (1) official tariff/port-fee announcements; (2) blank-sailing notices; and (3) Red Sea security updates — tactical booking and flexibility remain the prudent approach.

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.