Welcome To ChemAnalyst

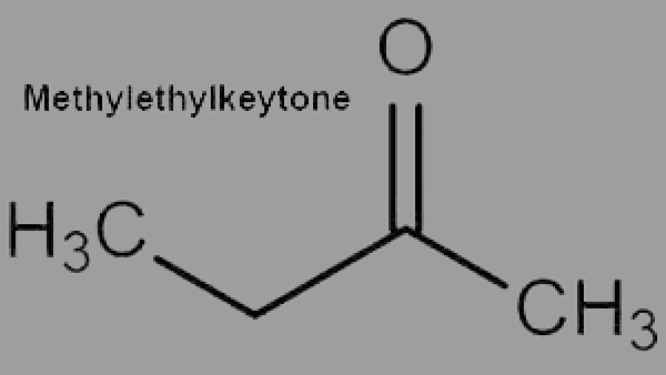

The prices of Methyl Ethyl Ketone (MEK), also known as Butanone, burgeoned in the Chinese market, showing an increase of 15 per cent on 25th March. The rising demand from end-use industries has laid the foundation for the price hike. Also, the spike in upstream crude values has further influenced the MEK prices.

Methyl Ethyl Ketone is the most widely used raw material in the production of printing inks, varnishes, paint removers, paints & coatings, and so on. Due to its strong dissolution properties, around 60 per cent of MEK is used in the paint & coating industry. Besides, the increasing global housing industry has led to solid growth of consumers toward the supreme quality of paint & coating, severely impacting the cost of MEK. As per the ChemAnalyst data, the prices of MEK in China were assessed at USD 2345 per MT for FOB Qingdao on 1st April.

Rapid industrialization and surging pharmaceutical industries in developing countries resulted in robust downstream demand in the global market. China is the major exporter of Methyl ethyl ketone, catering to the demand of Southeast Asia, far east Asia, and the European region. However, the upheaval caused due to the resurgence of COVID has wreaked havoc on trading activities. The surge in MEK demand on the global market and the delays in trade due to port congestion had a significant impact on MEK prices. In addition, the worldwide price of upstream crude oil and its derivatives has been affected by geopolitical tensions, which has hampered the expansion of the downstream MEK market internationally.

As per ChemAnalyst, “Methyl Ethyl Ketone cost might grow in the forthcoming weeks as downstream cleaning, paints, and paraffin wax are expected to be in robust demand. MEK is widely utilized in adhesives, chemical intermediates, printing inks, and other applications; thus, the rise of the end-use pharmaceutical, printing, and cosmetic sectors could boost MEK demand in the coming weeks. Besides, the upstream crude prices are likely to remain firm owing to strong demand from the global market and limited supply availability.”

We use cookies to deliver the best possible experience on our website. To learn more, visit our Privacy Policy. By continuing to use this site or by closing this box, you consent to our use of cookies. More info.