The global Insoluble Sulphur market stood at approximately 300 thousand tonnes in 2022 and is expected to grow at a healthy CAGR of 5.31% during the forecast period until 2030. Insoluble Sulphur is a universally recognized vulcanizing agent used widely in the rubber industry for improving product’s elasticity and strength. Insoluble Sulphur is widely used in high quality rubber components requiring high degree of tack and resistance to fatigue and ageing, particularly in radial tires, belting, cable and wire insulating materials and hoses.

The Insoluble Sulphur market is largely driven by its high demand in the global tire industry. With increasing number of on-road vehicles across the globe, the need for convenience and high maintenance tire replacements has been rising. The tire manufacturers across the globe are under pressure from regulators and consumers to develop more fuel-efficient tires, along with facing technological challenges to get a competitive edge in the highly crowded markets. Competitive pricing offered by automotive manufacturers across the globe has also created a surge in consumer spending on passenger cars in developing economies. Additionally, backed by rising usage of radialized tires in both passenger cars and commercial vehicles would most likely strengthen the role of Insoluble Sulphur across the automotive sector of the world. The content of Insoluble Sulphur is about 1.7 times higher in radial tires as compared to the bias tires. Surging demand for radialized tyre with the automotive industry’s strong focus on improving vehicle’s fuel efficiency, better mileage and lightweight characteristics, would most likely boost the demand for Insoluble Sulphur in the forecast period. In addition to this, with changing consumer preferences and innovation across the global footwear industry, increased role of Insoluble Sulphur in the footwear value chain would further accelerate the market growth in the years to come. Due to these factors clubbed up, the global Insoluble Sulphur market is anticipated to reach approximately 450 thousand tonnes by 2030.

In terms of grade, the Insoluble Sulphur market is bifurcated into Regular Grade, High Stability (HS), and Special Grade (SG). Majorly, the regular grade is leading the global Insoluble Sulphur market owing to its increased usage across versatile rubber producing industries. Regular grade Insoluble Sulphur is majorly the one with no additive mixtures and is commercially considered as the most primary form of insoluble Sulphur. Rising requirement for High Stability and High Dispersion grades due to their high level of thermal stability and enhanced characteristics to serve customizable applications would bolster the demand for Insoluble Sulphur in the forecast period.

As of 2023, Asia-Pacific has been playing as the major consumer of the Insoluble Sulphur. This region consumed roughly 61% share in terms of volume in 2022. Due to rapid industrialization across China, India, Japan, South Korea and multiple other Asian countries, there has been exponential growth in the consumer spending on automobiles. Moreover, the region also contributes a major portion of footwear produced in the world thereby generating a major portion of the global Insoluble Sulphur demand throughout the year.

Based on the end-user industry, the Insoluble Sulphur market is segmented into sectors like Tyre, Hoses, Rubber Sheets, and Others. Although, the Tyre industry is the dominating the Insoluble Sulphur market. In 2022, this industry held approximately 74% of the market share. Due to the rising demand of tyres for commercial and personal vehicles, the demand of Insoluble Sulphur as a vulcanizing agent is anticipated to rise in the forecast period.

Significant players in the Global Insoluble Sulphur market are Eastman Chemical Company, China Sunshine Chemical Co. Ltd., Shikoku Chemicals Corporation, Oriental Carbon & Chemicals Ltd, Luoyang Sunrise Industrial Co., Ltd, Henan Kailun Chemical Co., Ltd, Grupa Azoty S.A., Weifang Jiahong Chemical Co., Ltd.and others.

Years considered for this report:

Historical Period: 2015- 2022

Base Year: 2022

Estimated Year: 2023

Forecast Period: 2024-2030

This report will be delivered on an online digital platform with one-year subscription and quarterly update.

The objective of the Study:

•To assess the demand-supply scenario of Insoluble Sulphur, which covers the production, demand, and supply of Insoluble Sulphur around the globe.

•To analyze and forecast the market size of Insoluble Sulphur.

•To classify and forecast the Global Insoluble Sulphur market based on end-use and regional distribution.

•To examine global competitive developments such as new capacity expansions, mergers & acquisitions, etc., of the Insoluble Sulphur market.

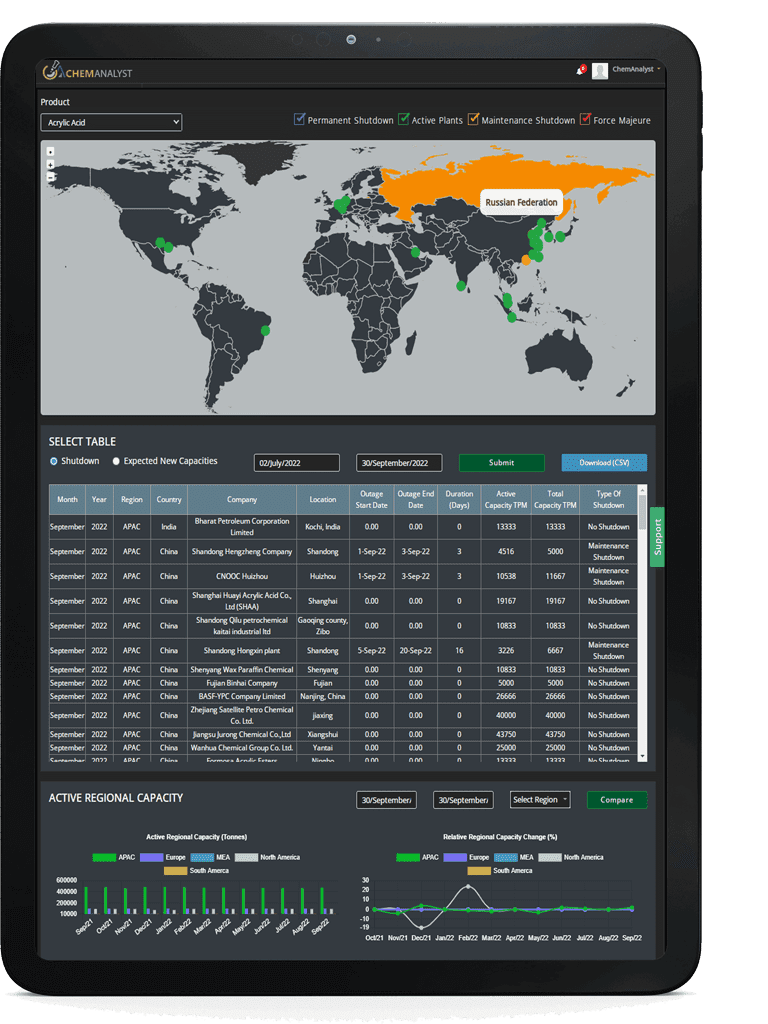

To extract data for the Global Insoluble Sulphur market, primary research surveys were conducted with Insoluble Sulphur manufacturers, suppliers, distributors, wholesalers, and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for the Global Insoluble Sulphur market over the coming years.

ChemAnalyst calculated Insoluble Sulphur demand in the globe by analyzing the historical data and demand forecast which was carried out considering the supply and demand of Insoluble Sulphur across the globe. ChemAnalyst sourced these values from industry experts, and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

• Insoluble Sulphur manufacturers and other stakeholders

• Organizations, forums and alliances related to Insoluble Sulphur distribution

• Government bodies such as regulating authorities and policy makers

• Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Insoluble Sulphur manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years, thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Insoluble Sulphur market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

|

Attribute

|

Details

|

|

Market size Volume in 2022

|

300 thousand tonnes

|

|

Market size Volume by 2030

|

450 thousand tonnes

|

|

Growth Rate

|

CAGR of 5.31% from 2023 to 2030

|

|

Base year for estimation

|

2023

|

|

Historic Data

|

2015 – 2022

|

|

Forecast period

|

2024 – 2030

|

|

Quantitative units

|

Demand in thousand tonnes and CAGR from 2023 to 2030

|

|

Report coverage

|

Industry Market Size, Capacity by Company, Capacity by Location, Production by Company, Demand by End- Use, Demand by Grade, Demand by Region, Demand by Sales Channel, Demand-Supply Gap, Company Share

|

|

Segments covered

|

By End-Use: (Tyre, Hoses, Rubber Sheets, and Others)

By Sales Channel: (Direct Sale and Indirect Sale)

|

|

Regional scope

|

North America, Europe, Asia Pacific, Middle East and Africa, and South America.

|

|

Pricing and purchase options

|

|

With the given market data, ChemAnalyst offers customizations according to a company’s specific needs.